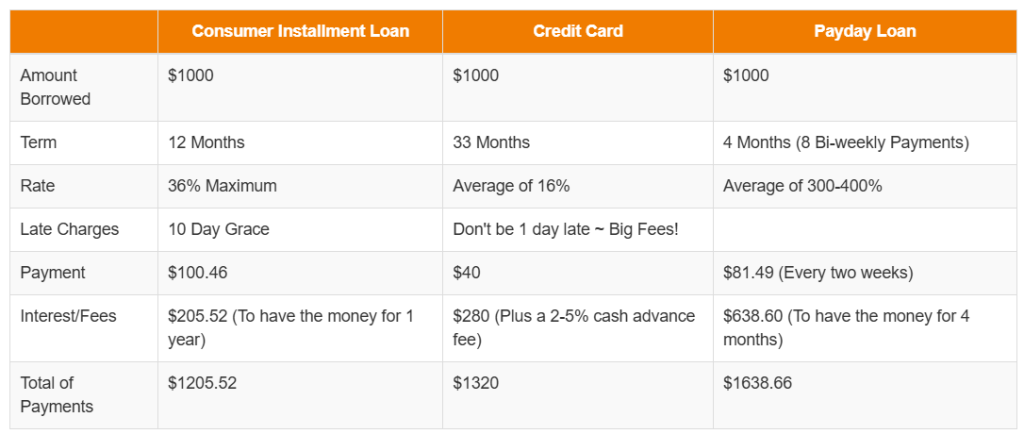

When you choose a consumer finance loan over a credit card and/or title/payday loan you know what you are getting into. You will be able to budget in your exact monthly payment, you will know exactly how much your interest charges will be, and you will know exactly how long it will take you to pay back the loan if you make your payments as scheduled.

Consumer Installment Loan

The smarter choice! In this example, if you were to borrow $1,000 from LPI Loans (if your budget allows), we would set you up on a 12 month term. You would make 12 payments of $100.46. You know your exact payment for exactly how long and exactly how much you would repay if you make your payments on time. Easy to budget and you know what to expect!

Credit Card

Is a lower rate always better? A credit card may carry a lower rate, however, if you only pay the minimum due each month this could cost you more in the long run. With a credit card, the payment varies and you do not always know how long it will take to pay off. In our example, we used a 4% minimum payment of the original balance. If you pay that same amount, it will take you about 33 months to pay off the $1,000 of debt. Most credit cards also charge a cash advance fee of 2-5%. We estimate in this example that even though your rate is lower, it would take 21 extra months to pay off the card and $320 in interest/fees based on an estimated minimum due payment. If you are very disciplined and can hold yourself to the higher payment, than this may work for you. For many customers, a fixed, budget friendly payment is the way to go. Click the “Let’s Get Started” button below!

Payday Loan

No question. This is expensive! A payday loan has a purpose, but statistics show that for every 10 people that take out a payday loan:

- 2 1/2 will pay off on time

- 2 people will renew 1 or 2 times

- 1 1/2 will renew 3 or 4 times

- 4 out of ten will renew the loan 5 or more times

Fees and/or interest rates average between 300-400%. (Data was compiled from a 2008 national survey, patterns may vary.)